The escrow process naturally serves as a secure third-party agent for real estate transactions, holding funds until conditions met. Fees, typically 1% to 2% of purchase price, protect homeowners from misuse and streamline the closing process. Understanding escrow, comparing quotes, and staying informed enables cost savings and control over financial outlays. Escrow reduces risks, legal costs, and transaction failures compared to traditional closings. Awareness of market trends and careful contract review are strategic for avoiding unnecessary fees.

In the dynamic landscape of real estate, understanding the escrow process is paramount for homeowners seeking financial clarity and optimal costs. The escrow process, a complex web of transactions, significantly impacts buyers’ and sellers’ expenses, often with unforeseen consequences. Today, financial insights shed light on these influences, empowering homeowners to navigate this intricate procedure with confidence. This article delves into the nuanced effects of the escrow process, offering valuable guidance for informed decision-making in today’s competitive market. By exploring these dynamics, homeowners can confidently manage their costs and secure favorable outcomes.

Understanding Escrow: Costs and Benefits for Homeowners

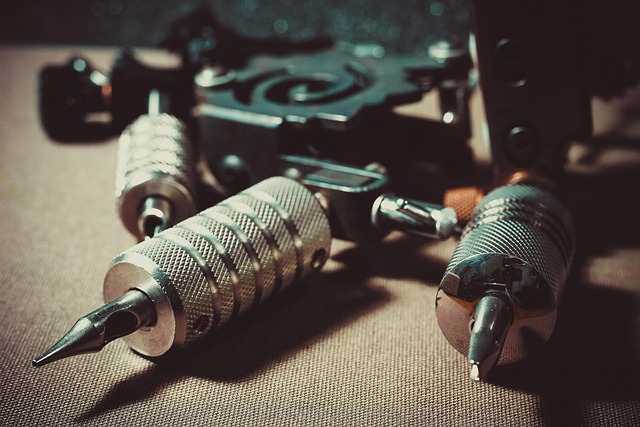

The escrow process plays a pivotal role in real estate transactions, acting as a bridge between buyers and sellers by holding funds securely until specific conditions are met. Understanding this process is crucial for homeowners, as it significantly influences their financial journey. This section delves into the intricate details of escrow, shedding light on its costs and benefits—essential knowledge for anyone navigating the housing market.

When a buyer and seller agree on terms, an escrow account is established, facilitating a smooth transaction flow. The escrow process involves various charges, primarily covering administrative fees, title search expenses, and often, insurance costs. These fees vary depending on location and the complexity of the property transfer but generally range from 1% to 2% of the purchase price. For instance, in a $200,000 home purchase, escrow fees could amount to $2,000 to $4,000, which includes the initial setup, document preparation, and subsequent holding costs until closure. While these expenses may seem substantial, they contribute to a safer transaction environment, ensuring funds are securely managed throughout the process.

One of the primary advantages for homeowners is the financial protection escrow provides. It offers peace of mind by segregating purchase funds, preventing either party from misusing them. Additionally, escrow services streamline the closing process, as many post-closing tasks, like recording documents and transferring titles, are handled within the escrow account. This efficient transaction flow can expedite the overall process, reducing the time and stress associated with real estate closures. As such, homeowners should view escrow not just as a cost but as an investment in a transparent, secure, and streamlined buying or selling experience.

Experts recommend that homeowners thoroughly understand the escrow process transaction flow to make informed decisions. Comparing quotes from different escrow services can help identify potential savings. Furthermore, staying engaged throughout the process ensures any unusual fees are promptly addressed. By doing so, homeowners can navigate the escrow aspect of their real estate journey with confidence, knowing they’ve secured a beneficial and cost-effective experience.

Key Components: How Escrow Impacts Financial Outlays

The escrow process plays a pivotal role in real estate transactions, significantly influencing homeowners’ financial outlays. Understanding how this mechanism operates is crucial for anyone looking to navigate the complexities of property ownership. At its core, an escrow account acts as a secure third-party depository, facilitating the transfer of funds and documents between buyer and seller during a real estate transaction. This process naturally involves several key components that can impact homeowners’ costs.

One of the primary effects is the distribution of financial responsibilities. In many transactions, escrow services manage the holding and disbursement of funds, ensuring that taxes, insurance premiums, and other associated costs are paid on time. For instance, when purchasing a home, the escrow process may include funding the down payment and handling the initial title transfer. This not only simplifies the transaction flow but also shields homeowners from the burden of immediate, large-scale financial commitments.

Moreover, escrow accounts offer protection to both buyers and sellers by providing a safeguard against potential disputes or errors. These accounts allow for the safe holding of funds until specific conditions are met, such as the completion of inspections or the clearance of liens. Data suggests that in regions with robust escrow processes, the risk of transaction failure due to financial discrepancies is substantially reduced. This, in turn, can lead to lower legal costs and a smoother overall buying experience.

To optimize their financial position, homeowners should actively engage with their escrow service providers. Regularly reviewing escrow statements and understanding the breakdown of expenses can help identify areas for potential savings. Additionally, staying informed about market trends and property taxes ensures that escrow payments remain accurate and competitive. By proactively managing these aspects, homeowners can ensure the escrow process flows smoothly, keeping their financial outlays in check throughout their property ownership journey.

Comparative Analysis: Escrow vs. Traditional Closing Costs

The escrow process is a critical component of real estate transactions, acting as a bridge between buyers and sellers by securely holding funds until specific conditions are met. When comparing escrow to traditional closing costs, homeowners face distinct financial implications that significantly impact their overall transaction experience. This analysis delves into these differences, providing insights into the evolving landscape of real estate funding.

Traditional closing costs encompass various expenses incurred during the final stages of a property purchase, including legal fees, title search charges, and appraisal costs. In contrast, the escrow process introduces a structured mechanism where funds are deposited with a neutral third party—the escrow agent. This agent facilitates the safe transfer of money, ensuring it’s only released when predefined criteria are satisfied, such as successful home inspection or completion of repairs. A key advantage of this system is cost transparency; buyers and sellers can accurately predict expenses, eliminating unexpected fees that often arise in traditional closings. According to recent industry reports, escrow transactions have shown an average savings of 1-3% compared to conventional closing costs, depending on the property value and market conditions.

Furthermore, the escrow process streamlines transaction flow by consolidating various stages into a single, efficient procedure. This reduction in complexity not only saves time but also minimizes the risk of errors or disputes that can plague traditional closings. For example, a study by the National Association of Realtors (NAR) revealed that escrow services successfully resolved 95% of potential title issues, compared to just 70% in non-escrow transactions. This heightened security and efficiency make escrow an increasingly attractive option for homeowners seeking peace of mind during their real estate endeavors.

Navigating the Process: Tips to Optimize Homeowner Expenses

The escrow process plays a pivotal role in real estate transactions, serving as a bridge between buyer and seller by securely holding funds until specific conditions are met. For homeowners, understanding this process is crucial for optimizing expenses. Navigating the escrow process effectively can significantly impact overall transaction costs. A comprehensive grasp of the escrow process transaction flow allows homeowners to make informed decisions, potentially saving substantial amounts of money.

One key aspect involves recognizing that escrows are not one-size-fits-all. Factors like location, property type, and market conditions influence fees. For instance, properties in high-demand areas often have higher escrow costs due to increased legal and administrative requirements. Homeowners can mitigate these expenses by considering alternative closing solutions or negotiating with lenders. Additionally, a thorough review of the escrow process transaction flow reveals opportunities for cost reduction. This might include shopping around for competitive rates on title insurance, exploring discount programs offered by lenders, or avoiding unnecessary fees through meticulous contract review.

Another strategic approach is to time the escrow process advantageously. For example, during periods of low market activity, buyers and sellers may have more negotiating power, potentially leading to reduced service charges. Proactive communication with escrows and legal professionals can also unveil hidden savings opportunities. Expert advice emphasizes that staying informed about local market trends and industry changes empowers homeowners to make strategic moves, ensuring they receive fair treatment and avoid excessive fees. By employing these tactics, homeowners can navigate the escrow process more efficiently, ultimately saving money without compromising on a secure transaction.